XE Money Transfer Review

Do you need to transfer money to Internation Country? Then

We already covered all the convinient method to Transfer Money in our other post. This post is more centered around the review of XE Money Transfer and the review of their product and services.

If you are in Europe and wouild like to travel a lot then we would also recommend you to check out our post around Revolut Travel Card Review which is by far the best travel card which you can take to save the money for the conversion cost in Europe.

Who is XE Money Tranfer for?

Established in 1993, they have been managing in unfamiliar trade for quite a while. The way that they don’t charge move expenses or have a base exchange sum make them very appealing.

But before you waste any more time:

Pros and Cons of XE Money Transfer?

Pros

- Being a very notable and believed brand can reassure you

- They have an extremely useful site that can stay up with the latest with any cash news

- No exchange expenses, regardless of the sum you’re moving, and no base exchange sum

- Support accessible for the two people and organizations

- Great and effectively available client care

Cons

- Restricted monetary standards accessible to move

- Not the least expensive choice for little, customary exchanges

- They don’t acknowledge installment with money or check

- No client assistance on ends of the week

- XE money number cruncher doesn’t statement the genuine rate you get for your exchange

When to use (and avoid) XE Money Transfer to transfer money overseas

With serious rates and no expenses, there is a great deal to like about XE Money Transfer. Furthermore, in the event that you haven’t made an exchange previously, you could particularly like that they are a laid out and believed cash brand. They’re really great for moves of all sizes as they don’t have a base add up to move. In any case, they’re not the least expensive choice, particularly for little, standard exchanges to certain nations.

XE can uphold your for both individual and business needs. They additionally have client service who can help you to do everything with respect to your exchange on the web, or regardless of whether you simply have a few inquiries.

How to use XE Money Transfer

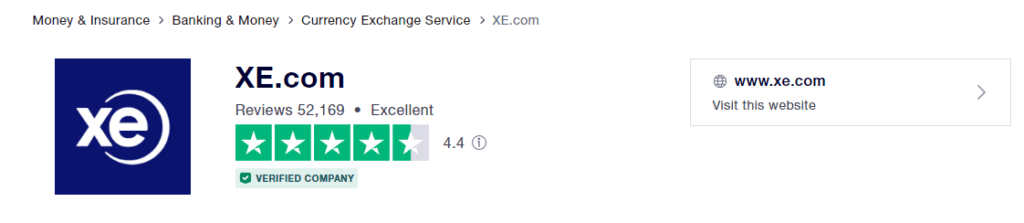

What do XE customer reviews say?

For the most part clients on Trustpilot talk well about their encounters with XE. Numerous clients talked about the dependability of the organization, the speed of their exchanges and their effectiveness.

The most well-known grievance about XE is that their client assistance group are lethargic or pointless. Protests were during end of the week hours however, when XE support isn’t free. Clients communicated dissatisfactions over absence of help when they:

- expected to change something about their exchange

- ran into a mechanical detour

- basically required help out of hours.

This is many times not an issue on the off chance that everything goes without a hitch and you’re cheerful doing everything on the web.

How to contact XE if you have a problem

Email Support: [email protected]

Is XE Money Transfer safe?

An inquiry we frequently get is XE Money Transfer really genuine? The response is yes.

XE treat their legitimate liabilities exceptionally in a serious way. They are controlled in each country they work in, remembering ASIC for Australia. They work under HiFX’s Australian monetary administrations permit number, an organization they’ve converged with. These are extremely severe rules that XE should continue to send your cash.

They additionally go to lengths to safeguard the delicate information you give them, similar to your own subtleties and recognizable proof. They consent stringently with their protection strategy to guarantee any information you give to them is protected.

How long does XE Money Transfer take to transfer funds?

It can take anyplace between 1 to 4 working days for a cash move. This is whenever you have set up your exchange with XE, which you can do internet based 24 hours every day, 7 days per week.

Very much like with bank move times, the speed of move might rely upon extra factors:

- The nations you’re sending cash to and from. Each cash and nation is unique and timing relies on how rapidly your beneficiary’s bank can handle your cash.

- How you pay. Card installments are moment, however bank moves take more time.

- Security checks. Check cycle can add time to your exchange.

How much does XE Money Transfer cost?

XE doesn’t charge you a decent cash move expense. All things being equal, they put an edge on the conversion scale.

XE Exchange Rates

Trade rates presented by XE Money Transfer are by and large more cutthroat than the ones you get presented in a bank.

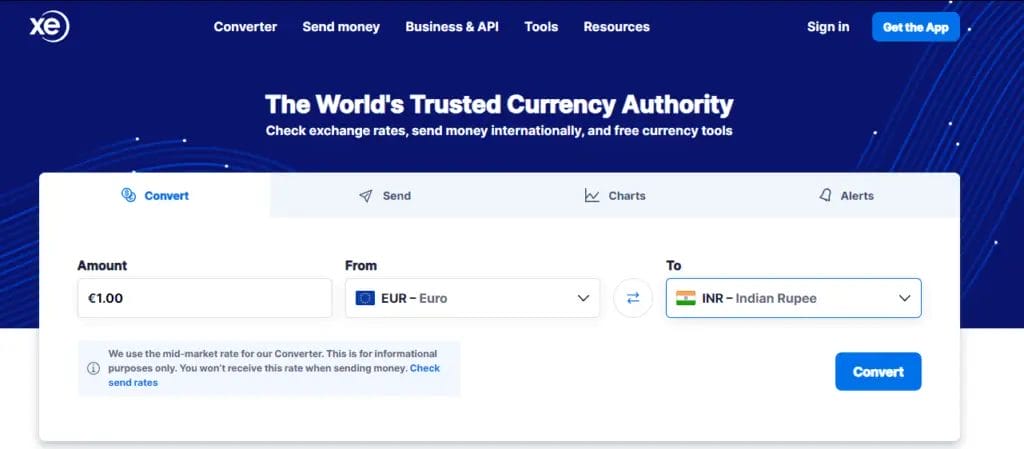

XE Currency Calculator

While

Does XE have an App?

At the point when you have a record with XE, you can make moves through their site, or through their iOS and Android applications.

The organization has an application to check money trade rates and one to make the genuine exchanges. Having this on your telephone will make it significantly more straightforward to make moves in a hurry on the off chance that you want to.

The XE application is accessible to both Apple and Android clients.

XE Business Products

XE can uphold your business in various ways. You can bringing in quick cash moves, or you can pursue market orders, or forward agreements.

At the point when you at first set up your record, you will be inquired as to whether you really want it for business or individual reasons. And that implies your record will be modified to best suit your requirements.

Alternative to XE Money Transfer

If you are looking for some alternative to XE Money Transfer then below are some which you should try out.

XE Money Transfer Review Verdict

Since the cost of the transfer is free then Xe Money Transfer is actually a good option for you to try.

That was our in-depth review of the XE Money Transfer. If you have any more questions then you can ask the same in our comment box below.

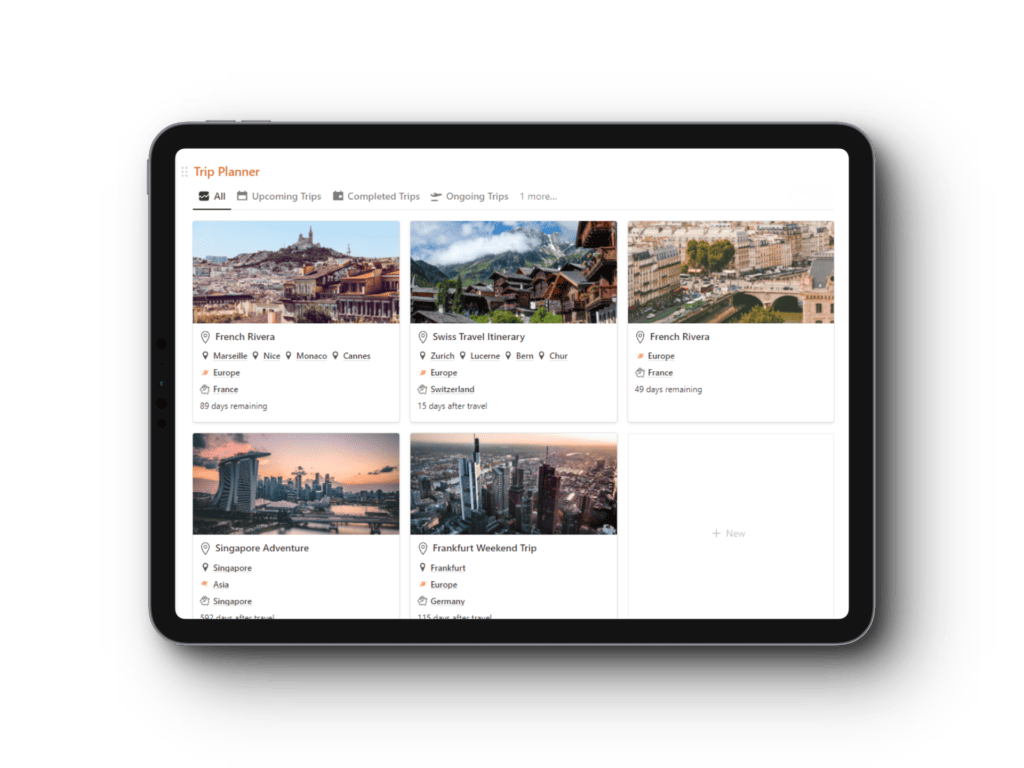

Get your Notion Travel Planner Template!

Embark on your next adventure with the Wanderlust Planner, the ultimate Notion Travel Planner Template. Organize your wanderlust-fueled dreams and turn them into unforgettable journeys. Whether you’re a seasoned globetrotter or a newbie explorer, this template has you covered.