Unlocking the Power of Plastic: 5 Key Advantages of Credit Cards

In today’s fast-paced, digital world, credit cards have become an indispensable tool for travellers, shaping our financial landscape. With their convenience and flexibility, they unlock a multitude of advantages that greatly enhance our travel experiences. From earning travel rewards and cash back to building credit while exploring the world, credit cards offer a new level of financial empowerment.

In this article, we will explore the top five travel advantages of credit cards that every savvy adventurer should know about. Whether you’re a seasoned globetrotter or just starting your travel journey, understanding these benefits will empower you to make the most of your financial choices while discovering new horizons. So, let’s dive in and explore how credit cards can help you take control of your travel finances and unlock a world of possibilities.

Convenience and Flexibility

Credit cards offer unparalleled convenience and flexibility in managing your finances. With a credit card in your wallet, you can make purchases online, over the phone, or in person without needing cash. This eliminates the hassle of carrying large sums of money or dealing with loose change. Additionally, credit cards provide a safety net for unexpected expenses or emergencies. Whether it’s a medical bill or a car repair, having a credit card allows you to tackle these situations with ease and peace of mind.

Moreover, credit cards offer flexible repayment options. You have the choice to pay off your balance in full each month, avoiding any interest charges, or make minimum payments to spread the cost over time. This flexibility allows you to manage your budget effectively and adapt to your financial circumstances. However, it’s important to be mindful of interest rates and fees associated with credit cards to ensure responsible usage and avoid unnecessary debt.

In summary, the convenience and flexibility offered by credit cards make them an essential tool in today’s modern world. They provide a secure and hassle-free way to make purchases, offer financial backup for emergencies, and allow for flexible repayment options.

Building Credit History and Improving Credit Score

One of the biggest advantages of credit cards is their ability to help you build and improve your credit history and credit score. Credit cards are considered revolving credit, which means they provide a continuous line of credit that you can use and repay on an ongoing basis. By using your credit card responsibly and making timely payments, you demonstrate to lenders and credit bureaus that you are a reliable borrower.

Your credit history and credit score play a crucial role in determining your financial health and eligibility for future loans or lines of credit. A positive credit history and a high credit score open doors to lower interest rates, better loan terms, and increased borrowing power. On the other hand, a poor credit history or a low credit score can limit your financial options and make it difficult to secure favourable loans or credit cards in the future.

To maximize the benefits of credit cards for building credit, it’s important to practice responsible credit card usage. This includes paying your bills on time, keeping your credit utilization ratio low, and avoiding excessive debt. By doing so, you can establish a solid credit history, improve your credit score, and unlock better financial opportunities.

Rewards and Cashback Programs

One of the most enticing advantages of credit cards is the opportunity to earn rewards and cashback on your purchases. Many credit cards offer rewards programs that allow you to accumulate points, miles, or cash back for every dollar you spend. These rewards can be redeemed for a variety of benefits, including travel, merchandise, gift cards, or statement credits.

The flexibility of rewards programs allows you to choose the type of rewards that aligns with your lifestyle and preferences. If you love to travel, you can opt for a travel rewards credit card that offers airline miles or hotel points. If you prefer cash back, there are credit cards that offer a percentage of your purchases back as a statement credit or direct deposit.

To make the most of rewards and cashback programs, it’s important to understand the terms and conditions of your credit card. Some cards may have restrictions or limitations on earning and redeeming rewards, while others may offer bonus categories that provide higher reward rates on specific types of purchases. By strategically using your credit card for everyday expenses and maximizing your rewards, you can enjoy significant savings and perks.

Purchase Protection and Fraud Prevention

Credit cards provide an added layer of protection when making purchases. Unlike cash or debit cards, credit cards offer certain consumer rights and protections that can safeguard your transactions. For example, many credit cards come with purchase protection, which can reimburse you for stolen or damaged items within a specific timeframe.

Furthermore, credit cards often have built-in fraud prevention measures to protect you from unauthorized transactions. Most credit card companies have sophisticated fraud detection systems that can identify and flag suspicious activity. If any fraudulent charges are made on your credit card, you are typically not liable for the unauthorized transactions, as long as you report them promptly.

In addition to these protections, credit cards also offer the convenience of easy dispute resolution. If you encounter a problem with a purchase, such as receiving a defective product or not receiving the item at all, you can contact your credit card company to initiate a dispute. The credit card company will investigate the issue and, if necessary, issue a chargeback, refunding you for the disputed amount.

These purchase protection and fraud prevention features provide peace of mind when making transactions, ensuring that you are not left financially responsible for fraudulent or unsatisfactory purchases.

Additional Benefits and Perks of Credit Cards

Beyond the core advantages mentioned above, credit cards often come with additional benefits and perks that can enhance your financial experience. These extras can vary depending on the card issuer, but some common examples include:

– Travel insurance: Some credit cards offer travel insurance coverage, including trip cancellation/interruption insurance, lost luggage coverage, and travel accident insurance.

– Extended warranties: Many credit cards extend the manufacturer’s warranty on eligible purchases, providing you with additional protection and peace of mind.

– Concierge services: Certain credit cards offer concierge services that can assist with travel bookings, reservations, and other personal assistance.

– Price protection: Some credit cards provide price protection, which means if you purchase an item and find it advertised at a lower price within a specified time frame, you may be eligible for a refund of the price difference.

– Access to airport lounges: Premium credit cards often grant access to airport lounges, allowing you to relax and enjoy complimentary amenities while waiting for your flight.

These additional benefits and perks can add significant value to your credit card usage, making them more than just a tool for financial transactions.

How to Choose the Right Credit Card for Your Needs

With so many credit card options available, choosing the right one can feel overwhelming. To make an informed decision, it’s essential to consider your financial goals, spending habits, and lifestyle. Here are some factors to consider when selecting a credit card:

– Annual fees: Determine if the card has an annual fee and whether the benefits and rewards outweigh the cost.

– Interest rates: Compare the interest rates offered by different cards, especially if you anticipate carrying a balance.

– Rewards programs: Evaluate the rewards programs and determine which type of rewards align with your preferences.

– Bonus categories: Some credit cards offer higher rewards rates on specific categories, such as groceries or gas. Consider your spending habits and choose a card that rewards your most frequent purchases.

– Introductory offers: Look for credit cards with introductory offers, such as waived annual fees for the first year or bonus rewards for a certain spending threshold.

– Credit score requirements: Understand the credit score requirements for each card and ensure you meet the eligibility criteria.

– Customer service: Research the reputation and customer service of the credit card issuer to ensure a positive experience.

By carefully considering these factors and comparing different credit card options, you can choose a card that aligns with your unique needs and maximizes the benefits you’ll receive.

Common Misconceptions about Credit Cards

Despite the numerous advantages of credit cards, there are still some common misconceptions that can deter people from utilizing them effectively. Let’s debunk a few of these misconceptions:

1. Credit cards always lead to debt: While it’s true that irresponsible credit card usage can lead to debt, it’s important to remember that credit cards themselves are not the problem. The lack of financial discipline and overspending can result in debt. By using credit cards responsibly and paying off your balance in full each month, you can avoid accruing interest charges and maintain control over your finances.

2. Closing unused credit cards improves your credit score: Closing unused credit cards can actually have a negative impact on your credit score. This is because it reduces your overall available credit, which can increase your credit utilization ratio. It’s generally advisable to keep unused credit cards open, especially if they have no annual fees, as they contribute to a longer credit history and lower your credit utilization ratio.

3. Applying for multiple credit cards will damage your credit score: While applying for multiple credit cards within a short period of time can temporarily lower your credit score due to hard inquiries, it’s not necessarily detrimental in the long run. If you manage your credit responsibly and make timely payments, the negative impact of these inquiries will decrease over time, and your credit score can actually improve as you build a positive credit history.

By understanding and debunking these common misconceptions, you can make informed decisions about credit card usage and leverage their advantages to your benefit.

Tips for Responsible Credit Card Usage

To make the most of your credit card and avoid potential pitfalls, it’s important to practice responsible credit card usage. Here are some tips to help you maintain a healthy financial relationship with your credit card:

1. Pay your bills on time: Late payments can result in late fees, increased interest rates, and negative marks on your credit report. Set up automatic payments or reminders to ensure you never miss a payment.

2. Keep your credit utilization ratio low: Credit utilization refers to the amount of credit you’re currently using compared to your total available credit. Aim to keep your credit utilization ratio below 30% to demonstrate responsible credit management.

3. Avoid carrying a balance: Whenever possible, pay off your credit card balance in full each month to avoid accruing interest charges. If you can’t pay in full, strive to pay more than the minimum amount due to reduce interest costs.

4. Monitor your credit card statements: Regularly review your credit card statements for any unauthorized charges or errors. Report any discrepancies to your credit card issuer immediately.

5. Be mindful of credit card fees: Familiarize yourself with the fees associated with your credit card, such as annual fees, balance transfer fees, or cash advance fees. Avoid unnecessary fees by understanding the terms and conditions of your card.

6. Regularly check your credit report: Obtain a free credit report annually from each of the major credit bureaus (Equifax, Experian, and TransUnion) and review it for any inaccuracies or suspicious activity. Reporting errors promptly can prevent potential damage to your credit score.

By following these tips and practising responsible credit card usage, you can fully leverage the advantages of credit cards while maintaining control over your financial well-being.

Conclusion

Credit cards have revolutionized the way we manage our finances, offering a wide range of advantages that can significantly enhance our everyday lives. From the convenience and flexibility they provide to the opportunities for building credit, earning rewards, and protecting our purchases, credit cards unlock a world of possibilities. By understanding the benefits and practising responsible credit card usage, you can take control of your finances, maximize the advantages of credit cards, and make informed choices that align with your financial goals. So, embrace the power of plastic and unlock a brighter financial future.

Read More:

How to save more money for travelling the world?

Revolut Travel Card Review

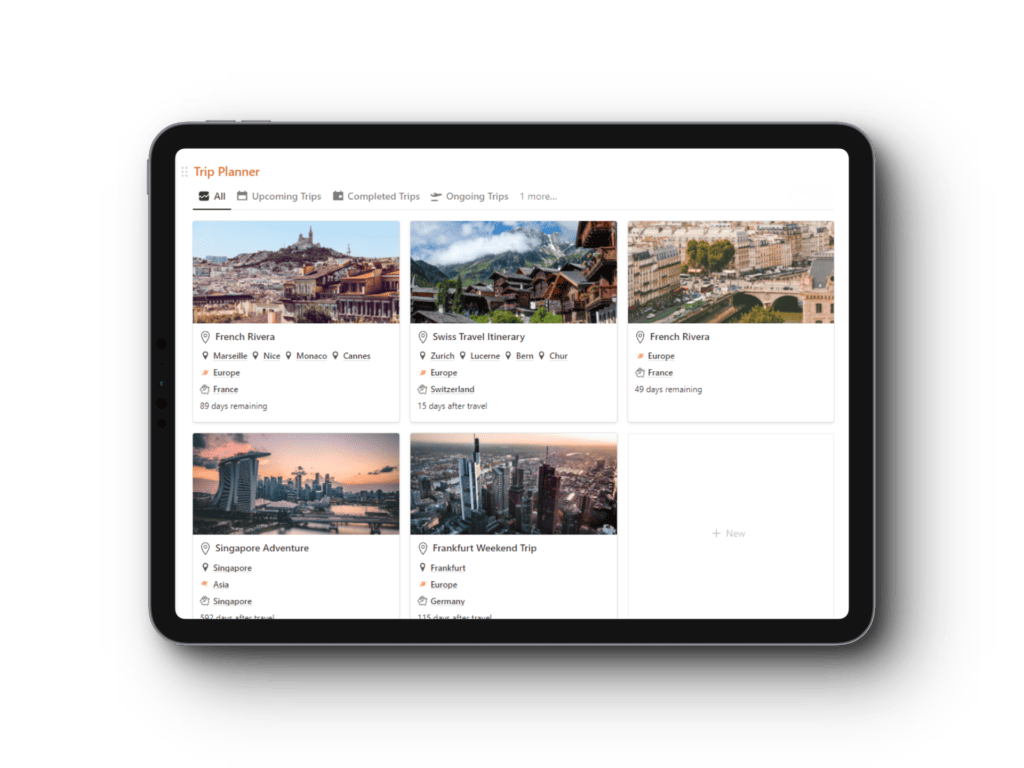

Get your Notion Travel Planner Template!

Embark on your next adventure with the Wanderlust Planner, the ultimate Notion Travel Planner Template. Organize your wanderlust-fueled dreams and turn them into unforgettable journeys. Whether you’re a seasoned globetrotter or a newbie explorer, this template has you covered.