Heymondo vs SafetyWing Travel Insurance (updated)

Traveling is an exciting adventure, but it also comes with risks. From lost luggage to flight cancellations, there are many things that can go wrong while you’re on the road. That’s why travel insurance is essential for any trip. In this article, we will compare Heymondo vs SafetyWing Travel Insurance, two popular travel insurance providers, to help you decide which one is the best fit for your needs.

Heymondo Travel Insurance and SafetyWing Travel Insurance are two of the most popular travel insurance options for digital nomads. Heymondo is a relatively new entrant in the market, while SafetyWing has been around since 2018. Both companies offer a range of travel insurance plans designed specifically for digital nomads.

However, there are some significant differences between the two. Heymondo is known for its innovative approach to travel insurance, while SafetyWing offers affordable insurance plans that are ideal for budget-conscious digital nomads. So, which one is better for you? Let’s find out.

Heymondo vs SafetyWing Travel Insurance: Overview

Heymondo Travel Insurance

Background Information

Heymondo Travel Insurance is a digital travel insurance company that offers comprehensive coverage for travelers. Founded in 2018 in Barcelona, Spain, Heymondo aims to provide innovative solutions for modern travelers.

Features of Heymondo Travel Insurance

- Instant Claim Payments: Heymondo offers an instant claim payment feature, which means that travelers can get their claim money transferred to their bank accounts within 24 hours of filing the claim.

- Customizable Coverage: Heymondo allows travelers to customize their coverage based on their needs. Travelers can choose from a range of coverage options, including medical expenses, trip cancellation, lost luggage, and more.

- 24/7 Assistance: Heymondo provides 24/7 assistance to travelers through its online platform. Travelers can get in touch with Heymondo’s customer support team through chat or phone.

- No Deductibles: Heymondo does not have any deductibles, which means that travelers do not have to pay any money out of their own pocket before their insurance coverage kicks in.

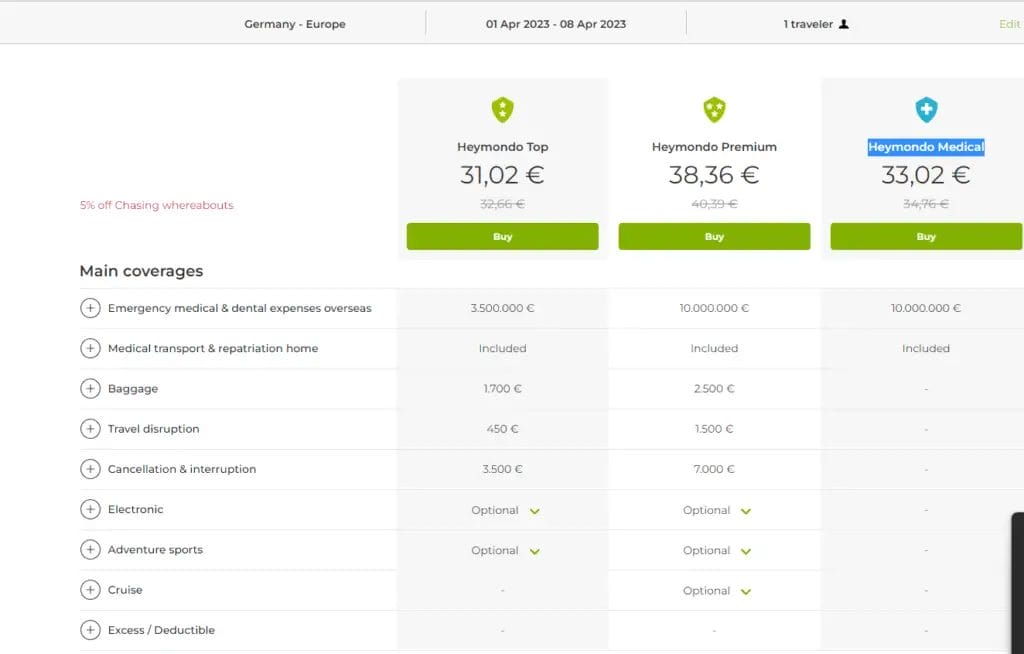

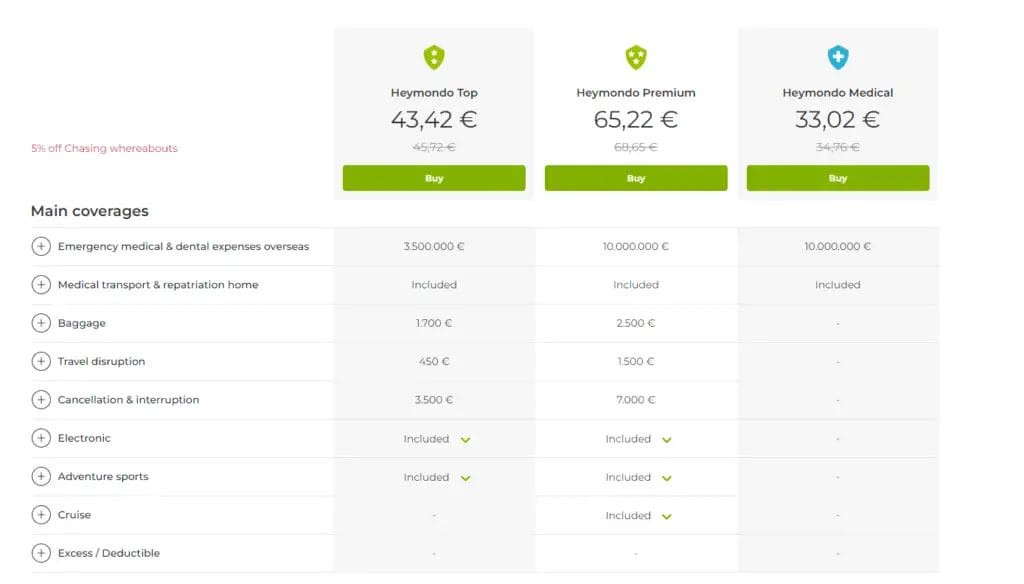

Types of Heymondo Travel Insurance Plans

Heymondo offers three types of travel insurance plans: Basic, Standard, and Premium.

- Heymondo Top: The Basic plan offers coverage for medical expenses, trip cancellation, and lost or delayed luggage.

- Heymondo Premium: The Standard plan offers the same coverage as the Basic plan, but with higher coverage limits and additional benefits such as trip interruption coverage and coverage for emergency medical evacuation.

- Heymondo Medical: The Premium plan offers the highest coverage limits and includes all the benefits of the Standard plan, as well as coverage for adventure sports, natural disasters, and more.

Sample cost for the Heymondo Travel Insurance for 1 week of travelling in Europe for one traveller.

I personally tend to include the Electornic and Adventure sports rider and here is the updated cost when you are including the Electronics and Adventure Sports rider in your plan.

Heymondo Travel Insurance Coverage and Benefits

- Medical Expenses: Heymondo covers medical expenses incurred due to illness or injury during the trip.

- Trip Cancellation and Interruption: Heymondo offers coverage for trip cancellation or interruption due to unforeseen circumstances such as illness, injury, or natural disasters.

- Lost or Delayed Luggage: Heymondo offers coverage for lost or delayed luggage, which includes reimbursement for the cost of essential items purchased due to the delay.

- Emergency Medical Evacuation: Heymondo covers the cost of emergency medical evacuation in case of a medical emergency during the trip.

- Adventure Sports Coverage: Heymondo offers coverage for adventure sports such as scuba diving, skiing, and more.

In summary, Heymondo Travel Insurance offers innovative features, customizable coverage options, and comprehensive benefits for travelers. With its instant claim payment feature and 24/7 assistance, Heymondo is a reliable option for travelers looking for hassle-free travel insurance.

SafetyWing Travel Insurance

Background Information

SafetyWing Travel Insurance is a digital travel insurance company that offers affordable travel insurance options for travelers. Founded in 2017, SafetyWing aims to provide flexible and budget-friendly travel insurance plans for digital nomads, remote workers, and long-term travelers.

Features of SafetyWing Travel Insurance

- Flexibility: SafetyWing offers flexible coverage options that can be customized based on the needs of the traveler. Travelers can choose from a range of coverage options, including medical expenses, emergency medical evacuation, trip interruption, and more.

- Budget-friendly: SafetyWing offers affordable travel insurance plans that are designed to cater to the needs of budget-conscious travelers.

- Automatic Renewal: SafetyWing’s travel insurance plans come with automatic renewal, which means that travelers do not have to worry about renewing their policies manually.

- 24/7 Assistance: SafetyWing provides 24/7 assistance to travelers through its online platform. Travelers can get in touch with SafetyWing’s customer support team through chat or phone.

Types of SafetyWing Travel Insurance Plans

SafetyWing offers two types of travel insurance plans: Standard and Explorer.

- Standard Plan: The Standard plan offers coverage for medical expenses, emergency medical evacuation, and trip interruption.

- Explorer Plan: The Explorer plan offers the same coverage as the Standard plan, but with higher coverage limits and additional benefits such as coverage for adventure sports and natural disasters.

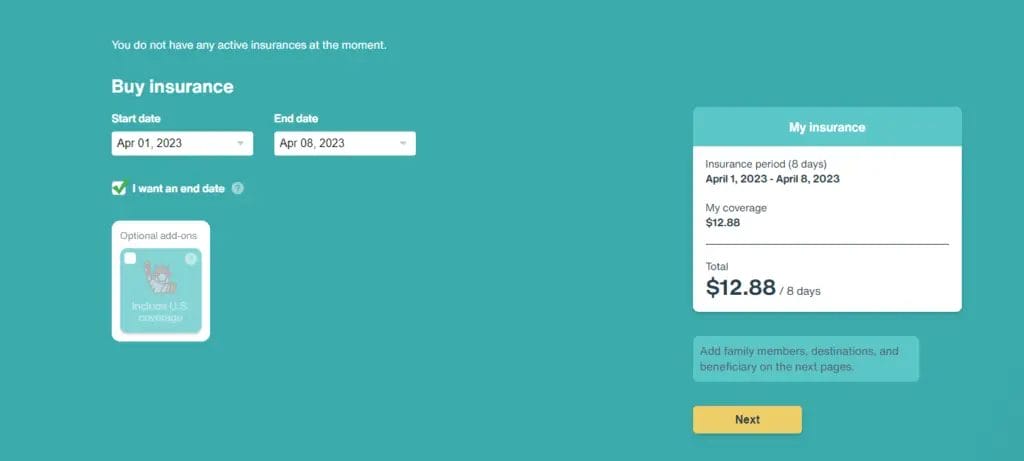

Below is the cost of Safetywing Travel Insurance for the same period as above.

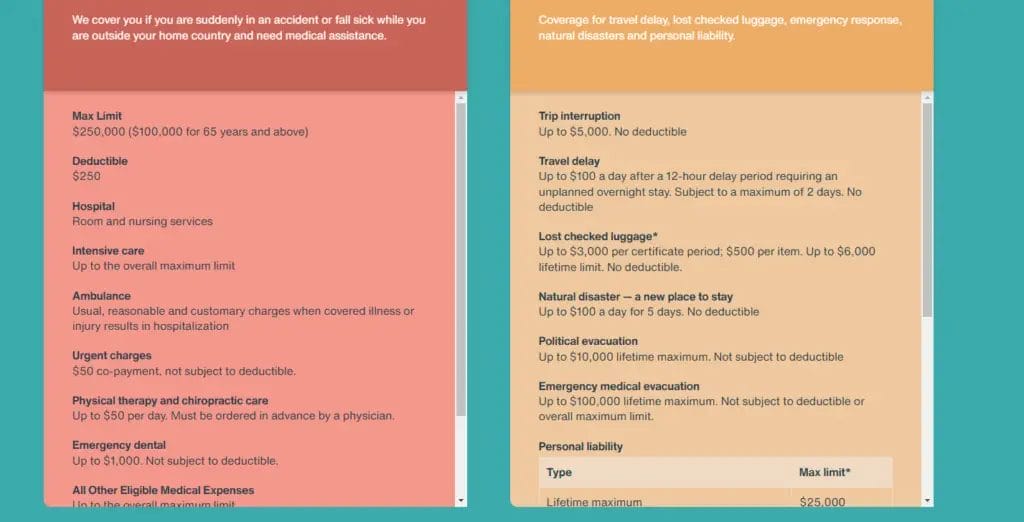

SafetyWing Travel Insurance Coverage and Benefits

- Medical Expenses: SafetyWing covers medical expenses incurred due to illness or injury during the trip.

- Emergency Medical Evacuation: SafetyWing covers the cost of emergency medical evacuation in case of a medical emergency during the trip.

- Trip Interruption: SafetyWing offers coverage for trip interruption due to unforeseen circumstances such as illness, injury, or natural disasters.

- Lost or Delayed Luggage: SafetyWing offers coverage for lost or delayed luggage, which includes reimbursement for the cost of essential items purchased due to the delay.

- Adventure Sports Coverage: SafetyWing offers coverage for adventure sports such as scuba diving, skiing, and more.

In summary, SafetyWing Travel Insurance offers flexible and budget-friendly travel insurance options for digital nomads and long-term travelers. With its automatic renewal feature and 24/7 assistance, SafetyWing is a reliable option for travelers looking for affordable travel insurance. While SafetyWing may not offer as many coverage options as Heymondo, it is an excellent choice for travelers on a tight budget.

Heymondo Travel Insurance vs SafetyWing Travel Insurance: Coverage Comparison

Heymondo Travel Insurance and SafetyWing Travel Insurance are two popular travel insurance companies that offer a range of coverage options for travelers. Here’s a comparison of their coverage options:

Medical Coverage

Heymondo offers medical coverage for up to €2,000,000, which includes emergency medical expenses, hospitalization, and medical evacuation. SafetyWing also offers medical coverage, but with lower coverage limits. The Standard plan covers medical expenses up to $250,000, while the Explorer plan covers up to $1,000,000.

Emergency Medical Evacuation

Both Heymondo and SafetyWing offer coverage for emergency medical evacuation. Heymondo covers up to €2,000,000 for emergency medical evacuation, while SafetyWing’s Standard plan covers up to $100,000, and the Explorer plan covers up to $250,000.

Trip Cancellation and Interruption

Heymondo provides coverage for trip interruption and cancellation brought by by unforeseeable events like illness, accidents, or natural catastrophes. Depending on the traveler’s plan choice, different plans have different coverage limits for trip cancellation and interruption. Together with travel interruption insurance, SafetyWing also provides trip cancellation insurance.

Lost, Stolen or Delayed Luggage

Both Heymondo and SafetyWing offer coverage for lost, stolen, or delayed luggage. Heymondo offers up to €3,000 for lost or stolen luggage, and up to €500 for delayed luggage. SafetyWing offers up to $3,000 for lost or stolen luggage and up to $500 for delayed luggage.

Personal Liability

Heymondo offers personal liability coverage up to €600,000, while SafetyWing does not offer personal liability coverage.

Adventure Sports Coverage

Heymondo offers coverage for adventure sports such as skiing, snowboarding, and scuba diving, while SafetyWing offers coverage for adventure sports in its Explorer plan.

COVID-19 Coverage

In addition to their regular coverage options, Heymondo and SafetyWing both offer COVID-19 coverage for travelers.

Heymondo’s COVID-19 coverage includes medical expenses, emergency medical evacuation, trip interruption, and trip cancellation due to COVID-19 related reasons such as a positive COVID-19 test result or travel restrictions imposed by a government authority. However, it is important to note that Heymondo does not cover trip cancellation or interruption due to fear of traveling or a change of mind.

SafetyWing’s COVID-19 coverage is included in all of their plans and includes medical expenses related to COVID-19 treatment as well as emergency medical evacuation. However, SafetyWing does not cover trip cancellation or interruption due to fear of traveling or a change of mind.

Travelers should carefully review the COVID-19 coverage options offered by both Heymondo and SafetyWing, as well as any exclusions or limitations, before making a decision on which travel insurance company to choose. It is important to understand the specific terms and conditions of the coverage to ensure that it meets the needs of the traveler.

Heymondo Travel Insurance vs SafetyWing Travel Insurance: Pricing Comparison

Heymondo Travel Insurance Pricing

Heymondo Travel Insurance offers three plans: Basic, Standard, and Premium. The Basic plan starts at $3.49 per day, while the Premium plan costs $12.99 per day. The price of each plan varies based on factors such as trip length and destination.

SafetyWing Travel Insurance Pricing

SafetyWing Travel Insurance offers one plan that costs $1.32 per day for people aged 18-39, $2.64 per day for people aged 40-49, and $3.96 per day for people aged 50-59. The price of the plan is the same regardless of the destination or trip length.

Heymondo Travel Insurance vs SafetyWing Travel Insurance: Pros and Cons

Heymondo Travel Insurance Pros:

- Innovative features such as instant claim payments and customized coverage

- Extensive coverage for adventure sports

- 24/7 chatbot for customer support

Heymondo Travel Insurance Cons:

- Higher pricing compared to other travel insurance options

- Limited coverage for pre-existing medical conditions

SafetyWing Travel Insurance Pros:

- Affordable pricing

- Comprehensive coverage for COVID-19-related expenses

- Coverage for pre-existing medical conditions

SafetyWing Travel Insurance Cons:

- Limited coverage for adventure sports

- No instant claim payments

Heymondo Travel Insurance vs SafetyWing Travel Insurance: Customer Service

Customer service is an important consideration when choosing travel insurance. Here’s how Heymondo Travel Insurance and SafetyWing Travel Insurance compare:

Heymondo Travel Insurance Customer Service:

Heymondo Travel Insurance provides 24/7 emergency assistance and offers customer support via phone, email, and live chat. The company also has a mobile app that allows customers to manage their policies and file claims.

SafetyWing Travel Insurance Customer Service:

SafetyWing Travel Insurance provides 24/7 emergency assistance and offers customer support via email and chat. The company also has a mobile app that allows customers to manage their policies and file claims.

FAQs: Heymondo Travel Insurance vs SafetyWing Travel Insurance

What is the minimum and maximum age limit for Heymondo Travel Insurance and SafetyWing Travel Insurance?

Does Heymondo Travel Insurance and SafetyWing Travel Insurance cover pre-existing medical conditions?

What is the process for filing a claim with Heymondo Travel Insurance and SafetyWing Travel Insurance?

Does Heymondo Travel Insurance and SafetyWing Travel Insurance offer worldwide coverage?

Does Heymondo Travel Insurance and SafetyWing Travel Insurance cover adventure sports?

Do Heymondo Travel Insurance and SafetyWing Travel Insurance offer coverage for lost or stolen luggage?

Does Heymondo Travel Insurance and SafetyWing Travel Insurance cover trip cancellation and interruption?

Can I purchase Heymondo Travel Insurance after I have started my trip?

Does SafetyWing Travel Insurance provide personal liability coverage?

Conclusion:

When it comes to choosing between Heymondo Travel Insurance vs SafetyWing Travel Insurance, it ultimately comes down to personal preference and individual needs. Heymondo is a great option for those looking for innovative features such as instant claim payments and personalized coverage, while SafetyWing is ideal for those on a budget who want comprehensive coverage at an affordable price.

Overall, both companies offer excellent travel insurance options for digital nomads. Before making a final decision, it’s essential to compare their coverage, pricing, and features to ensure that you choose the best plan for your needs. By doing so, you can travel with peace of mind knowing that you’re covered in case of any unexpected mishaps.